Wealth Management with NRI’s Perspective

Wealth management is a practice for centuries. Over a period, it has become a lot more sophisticated with new technologies. The invention of internet, availability of computers and other hardware, international cooperation with free trade practices, currency management and high-level education facilities have together contributed to modern times. It a high-level professional service that combines financial and investment advice. This utilisation of processes, services and products are designed to grow, protect, utilise and disseminate one’s wealth. Managing wealth differs with differing perspectives. For the affluent, it is a science and process used to solve, increase and protect financial situations. For the lower middle class, it could mean managing it for their business, children’s education, retirement and what not. Anyhow, it is a zone to ventured into only upon professional guidance. In the modern world, the techniques cover a wide variety of topics and in financial advisor’s perspective, wealth management is the ability of an advisor, consultant as well as advisory team to deliver a full range of financial services and products to an affluent client in accounting and tax services, retirement planning, legal or estate planning, wills and trusts, inheritance planning, life insurance, long-term care, credit cards, etc., for one set fee.

With this overview, I would venture into the first emigration of Indians that started more than 200 years ago during the British era in India and continues ever since. The relocation started with labor to doctors, engineers, businessmen, farmers and now teachers, artists, etc. The initial migration was to parts of Africa, the UK, the USA, Canada, Australia, New Zealand, Philippines, Singapore and Fiji. NRIs have strode forward in their country of residence in and in their field of expertise.

The notable migration and growth over a couple of centuries is over 30,000,000 people broadly categorised as follows:

-

- Africa 2,800,000 with majority in South Africa and Mauritius

-

- Asia 18,500,000 with majority in Saudi Arabia, United Arab Emirates Nepal, Malaysia

-

- Europe 1,800,000 with majority in United Kingdom

-

- Americas 6,100,000 with majority in United States, Canada

-

- Oceania 1,000,000 with majority in Australian and Fiji

This spread of NRI’s all over the world has meant not only prosperity to them but also to India in that they remit home millions of dollars. This helps their families in India and it also adds to India’s foreign exchange reserve. The following gives a brief glimpse of the numbers of millionaires NRIs, wealth and remittances to India.

-

- The total number of NRI millionaires was approximately 236,000 in 2015 with an average wealth of over US$3.83 million. Since then the number has grown.

-

- The USA accounted for the largest proportion of NRI millionaires, followed by the UK, the UAE, Canada, Hong Kong, Singapore and Indonesia.

-

- Gulf countries accounted for the largest share of remittances to India at US$72.17 billion in 2015 possibly followed by the USA and the UK.

-

- The value of the worldwide wealth management market for NRI millionaires was valued at US$788 billion in 2015 and is expected to increase to US$1.284 trillion in 2020.

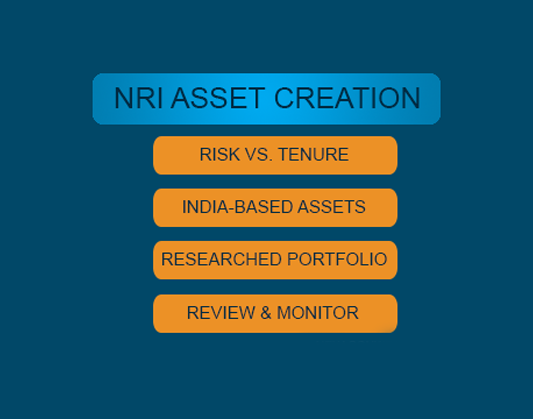

There are typical challenges for Wealth Management for NRIs. Many today are faced with the dilemma of wanting to invest in one of the world’s most attractive investment destinations and that often poses a problem and confusion to some degree.

As a new NRI, one has to put a certain things in place to start their wealth management afresh, which means notable changes and complexities too:

-

- Open non-resident NRE/NRO accounts to manage earnings originating in India as well as abroad

-

- Review existing mutual fund, real-estate and other investments

-

- Open Portfolio Investment Schemes (PIS) for making fresh investments in equity shares

-

- Check out the jurisdiction of existing insurance and health policies

Yet, with the dollar rate against the rupee can often leave NRIs bothered. While home mortgages are high in some countries, yet some responsibilities back in India are to be taken of. Considering such things, the Indian Union Budget gives many incentives for NRIs like certain exemptions, incentives and reliefs provided under Income Taxation scheme, some in starting a business, some against the remittance, etc. Foreign Currency Resident (Banking), India Millennium deposits, gold, real estate are the hot favourites of NRIs. Mutual funds, direct equities, life insurance have become recent hits. Recent times have also proved that at times, investing in financial products is at times better than remitting to relatives. “With the Indian economy booming, current stronghold investment avenues where an NRI can invest are mutual funds, real estate and PE funds,” says Rajesh Saluja, CEO, ASK Wealth Advisors. However, whatever one chooses, they have to be clear of their objective of investment, especially the one in India. Long term vs short term, use in India vs use in residential country. Drawing benefits in both forex and investment purpose is more or less impossible. It thus becomes important to understand where the investment is directed.

Union Budget 2019 has, indeed, brought some welcome changes for NRI investments. India now will have 18 diplomatic missions un Africa; Aadhar for NRIs is now simplified; NRI PIS route will be merged with the existing route for Foreign Portfolio Investors which will also mean a better coordination between RBI and SEBI, which in turn will improve NRI participation in Indian equities.

Well, not everything is as rosy. HNIs are to be hit by a higher surcharge of 25% on income above Rs 2 cr while income above Rs 5 cr will be 37%. A tax of 20% on buybacks have already discouraged NRIs from equities. Any transfer, money, gift, property, etc, from a resident Indian to NRIs too will have a tax imposed now.

Most of the NRIs, however, had modest expectations covering further liberalisation of baggage allowance, customs duty exemption for gold, reduction in some custom duties, legal reforms to enable them to invest in agricultural properties, removal of dividend distribution tax as it discourages companies from paying dividends. Another agenda on NRI wish list is an individual retirement account for them in lieu of pension plans. They also hope for further relaxation in tax rules to encourage people to invest in pension plans. Most NRIs want reduced GST rate for property transactions – from 12% to 5%.

One of the other aspects for wealth management which is still very much prevalent today is investment into precious metals like gold, silver and platinum as well as precious stones especially diamonds.

In conclusion, the role of NRI on the diaspora is one that India is proud of, not only for their financial success and wealth management but also their progress in education in almost all fields and contribution in their country of residence. The most notable treasure is their imbibing culture and heritage in day-to-day life.

Needless to say that their bonding and affiliation with the motherland has always been stronger for their own as well as India’s success.